The rise of the Internet and the digital world led to countless transformative innovations, from the iPhone and video streaming to Uber, Bluetooth, and more. Yet, for years, financial services lagged in digital innovation.

Take financial payments, for example. Making payments used to be costly, time-consuming, and on paper. To accept credit card payments online, retailers had to convince a bank to give them access to a merchant account or use an expensive payment gateway. Transferring money to a friend to split the cost of a meal used to require cash, a check, or a bank transfer. And cross-border payments to friends or family abroad required going to a physical office to make a wire transfer.

Transformative Fintech Innovation

That’s where financial technology companies came in. Stripe helped pioneer the innovative technology that allows digital payments with just a few lines of code on a website. Marqeta helped any fintech or commerce disruptor issue a card to their customers in a fraction of the time and cost. Innovators like PayPal and later Venmo, Cash App, and others created the infrastructure for online money transfers between people. And companies like Wise dramatically reduced the cost and complexity of making a global payment.

It’s easy to forget how much payment innovations have transformed daily life. Transactions that used to require a physical meeting, phone call, or cash can now be done online with the ease of pushing a button. Small local businesses can now build global e-commerce businesses. Everyday consumers can repay a friend or family member or send money abroad with just a smartphone. And all of us can order pizza for dinner, get it delivered to our doorstep, and pay for it on our app of choice, no cash required.

Breaking Down the Payments Process

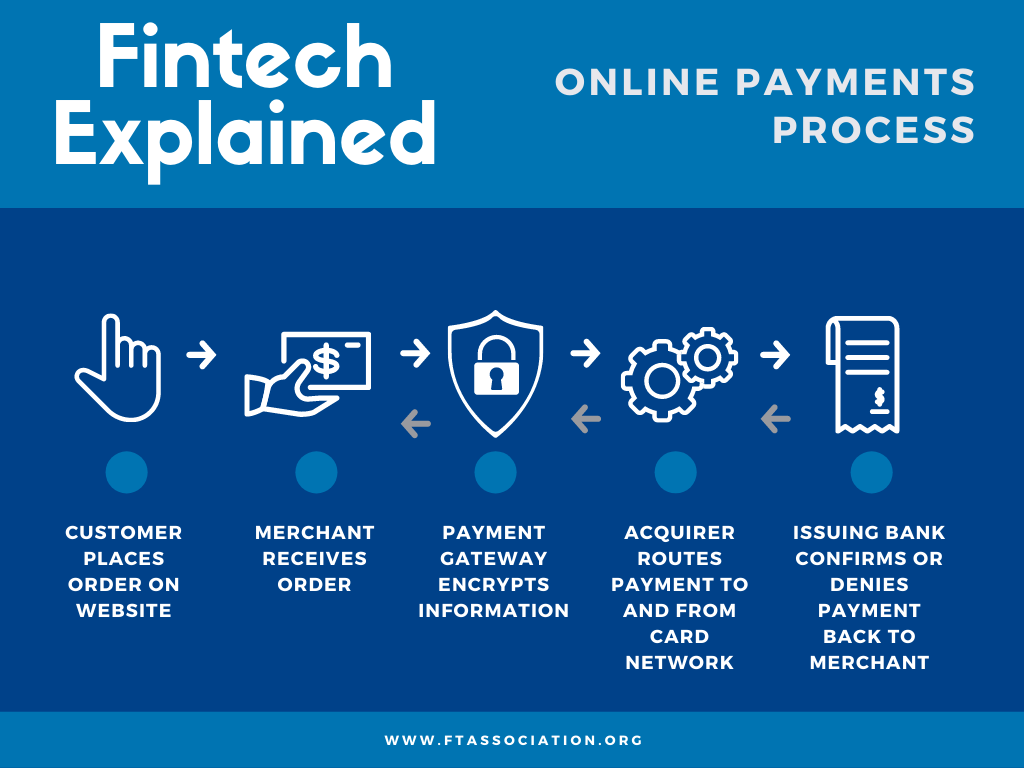

While simple for the user, making the payment is a multi-step process. Take paying for food delivery, for example. The cardholder or customer taps to make a purchase. The merchant or business owner must establish a relationship with an acquirer or the bank processing credit payments on behalf of the merchant and route them to card networks. A gateway securely captures and anonymizes payment details. Finally, the issuing bank, or the bank extending credit to consumers, will either confirm or decline payment so that the merchant can confirm with the customer — all within a nanosecond to ensure seamless delivery.

Financial technology companies play the role of the payment provider and offer gateway, processing, issuing, and acquiring services at scale for consumers and businesses worldwide. They do it while managing risk, mitigating fraud, protecting data, and minimizing friction for consumers at the point of sale, ensuring a seamless, simple, and affordable experience.

In the past, merchants had to build connectivity with every player — gateway, acquirer, card networks, issuing banks– in the transaction chain. This complexity made access to America’s financial infrastructure difficult and costly for small businesses. Financial technology removes a lot of that complexity so that business owners can focus on what they do best.

Next Steps for Payments Policy

While market innovation successfully identified and created solutions for the payments problem, there is room for the industry to grow and continue serving consumers. But, policymakers and regulators can take action to ensure this innovation can keep thriving.

Unlike other countries, which give payments companies access to central bank-run networks, the United States limits access to accounts and services at the Federal Reserve, the fastest way to make payments. Even though payments companies are subject to licensure and registration requirements, they lack direct access to the Federal Reserve payment rails that make payments more accessible and affordable for consumers. The status quo even creates risk in the payments system, as two banks originate nearly half of ACH transactions in the U.S. The same two banks originate payments for many large payments companies, adding single point of failure risks to our financial system.

Legacy financial institutions are eager to keep this arrangement in place because they collect fees to access the payments onramps, keeping money transfers slower and more expensive for small businesses and consumers. It’s time for the U.S. to modernize and clarify its payments system so that technology-driven financial services companies can improve access to financial rails for businesses, transform the marketplace for consumers, and benefit our economy.